san francisco payroll tax and gross receipts

Greater than 3001 a 03 overpaid executive tax rate. Businesses with more than 260000 in San Francisco payroll need to pay taxes to San Francisco.

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. The city began making the transition to a gross receipts tax from a payroll tax based on wages paid to employees in 2014. State Local Taxes.

San Francisco leaders in addition to putting the gross receipts. From imposing a single payroll tax to adding a gross receipts tax on various real estate entities including commercial. Starting in 2019 businesses will pay only the gross.

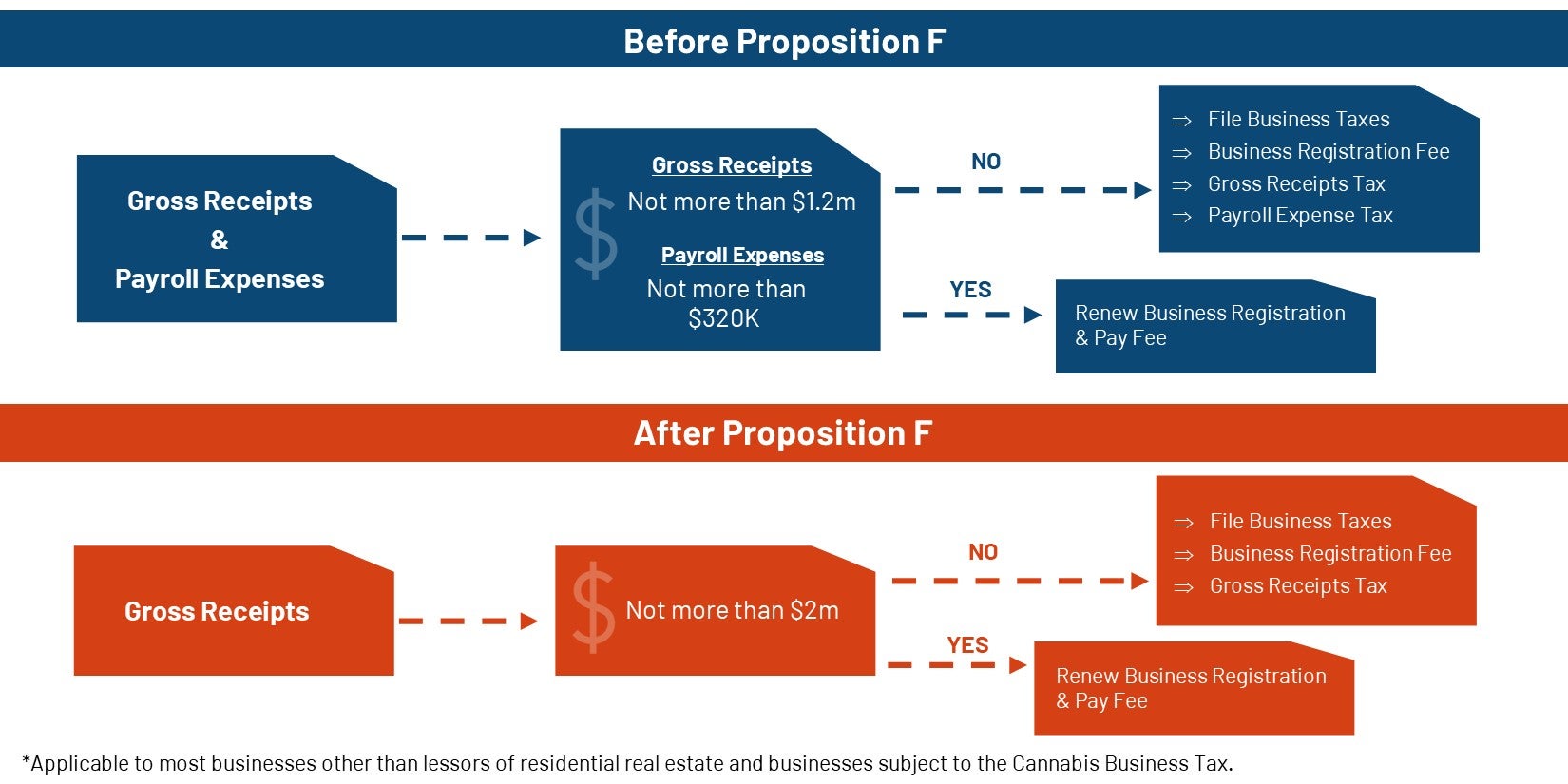

In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop E enacting the Gross Receipts Tax which went into effect on January 1 2014. F would fully repeal the payroll tax while also increasing gross receipts tax rates by 40 across all industries effective in January 2021. Beginning in 2014 the calculation of the SF Payroll Tax changes in two significant ways.

San francisco payroll tax and gross receipts. The citys gross receipts tax. For example an entity with an executive pay ratio of greater than 2001 would pay a 02 overpaid executive tax rate.

To avoid late penaltiesfees the returns must be submitted and paid on or before April 30 2021. The proposed gross receipts tax rates for all industries are shown in the table below. Due to all the changes many business owners are confused.

The measure is intended to replace over time San Franciscos 15 payroll expense tax. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation.

San francisco Gross Receipts. San Francisco PayrollGross Receipts Tax Changes. San Francisco Payroll Tax.

If the executive pay ratio exceeds 1001 then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 01 to 06 depending on the computed executive pay ratio. It was a brutal life Why young culinary talent is. From imposing a single payroll tax to adding a gross receipts tax on various real estate entities including commercial rentals and gathering funds to assist the homeless population.

For the Gross Receipts Tax GR we calculate 25 of your Gross Receipts Tax liability for 2021. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan. On November 6 2012 San Francisco residents approved Proposition E the Gross Receipts Tax Ordinance instituting a new gross receipts tax to replace the Citys 15 payroll tax.

San Francisco Could Follow Portland in Regulating CEO. For the Administrative Office Tax AOT we calculate 25 of. According to city representatives who emphasize a business-friendly image in line with The Industrial City hill sign it.

1 the tax begins its transition to the gross receipts tax so there is a declining payroll tax component. Tax year 2018 will be the last year of the payroll expense tax. Repeal of the Payroll Tax and an Increase in Gross Receipts Tax Rates Today because of the citys unfinished transition to a gross receipts structure most businesses in San Francisco pay both a payroll tax and a gross receipts tax.

San Francisco businesses are also subject to annual registration fees based on San Francisco gross receipts for the immediately preceding tax year. In addition to transitioning from a Payroll Expense Tax to a Gross Receipts Tax Prop E also shifts the Citys Business Registration Fee to be measured by gross. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

In short a phasing out of the current payroll tax will begin in 2014 and by 2018 businesses in the City of San Francisco the City will file Gross Receipts Tax returns and pay the annual Gross Receipts Tax which will be measured by the businesss gross receipts from all. Annual business registration fees. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes.

The City of San Francisco passed The Gross Receipts Tax and Business Registration Fees Ordinance ie Proposition E on November 6 2012. City and County of San Francisco. To avoid late penaltiesfees the returns must be submitted and paid on or before February 28 2022.

Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. This would be in addition to San Franciscos existing gross receipts tax. The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022.

1 the tax begins its transition to the gross receipts tax so there is a declining payroll tax component and an increasing gross receipts tax. South San Francisco does not levy gross receipts or payroll taxes although companies have to pay a business fee of up to 125000 per year. Businesses with more then 1 Million in Gross Receipts need to pay taxes to San Francisco.

What To Know About the San Francisco Payroll and Gross Receipts Tax. Annual business registration fees. If your 2021 gross receipts were less than 2000000 you do not have to pay any estimated payments for 2022.

Lean more on how to submit these installments online to comply with the Citys business and tax regulation. File Annual Business Tax Returns 2021. The progressive tax rate ranges between 01 to 06 and is assessed on gross receipts sourced to San Francisco as determined for Gross Receipts Tax purposes.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses. Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses. Gross Receipts Tax GR Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

File Annual Business Tax Returns 2020. FEB 2 SF Annual Gross Receipts Tax for 2020 filing payment deadline Gross Receipts tax rates in San Francisco can vary depending on a business gross. Beginning in tax year 2014 for five years the San Francisco payroll expense tax rate will be incrementally reduced and the gross receipts tax rate will be correspondingly increased to allow time to adjust to the gross receipts tax.

South San Francisco is a city in San Mateo County California United States. Under the general rule the registration fee is 90 for businesses with less than 100000 in receipts which increases to 35000 for businesses with more than 200 million in gross.

Payroll Tax Analyst Resume Samples Velvet Jobs

San Francisco Gross Receipts Tax

Due Dates For San Francisco Gross Receipts Tax

Gross Receipts Tax And Payroll Expense Tax Sfgov

San Francisco Payroll And Gross Receipts Tax Liability 101 Youtube

Coronavirus Stimulus Checks What To Know About Mail Delivery Subscription Boxes For Kids Kids Boxing Credit Card Images

Payroll Compliance And Tax Filing Services Rippling

Annual Business Tax Returns 2020 Treasurer Tax Collector

San Francisco S New Local Tax Effective In 2022

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa